This report, produced by Luxembourg For Finance and Deloitte, details the state of Luxembourg’s financial centre. The sector’s added value to the economy grew by 5.2% CAGR between 2011 and 2021, tax revenues by a 5.1% CAGR over the same period, and the trickle down effect includes over 70,000 jobs created by indirect or induced effects in 2021.

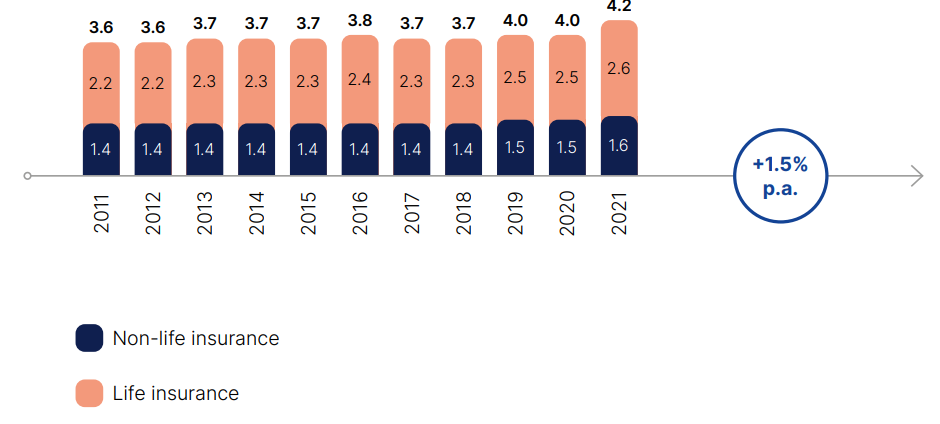

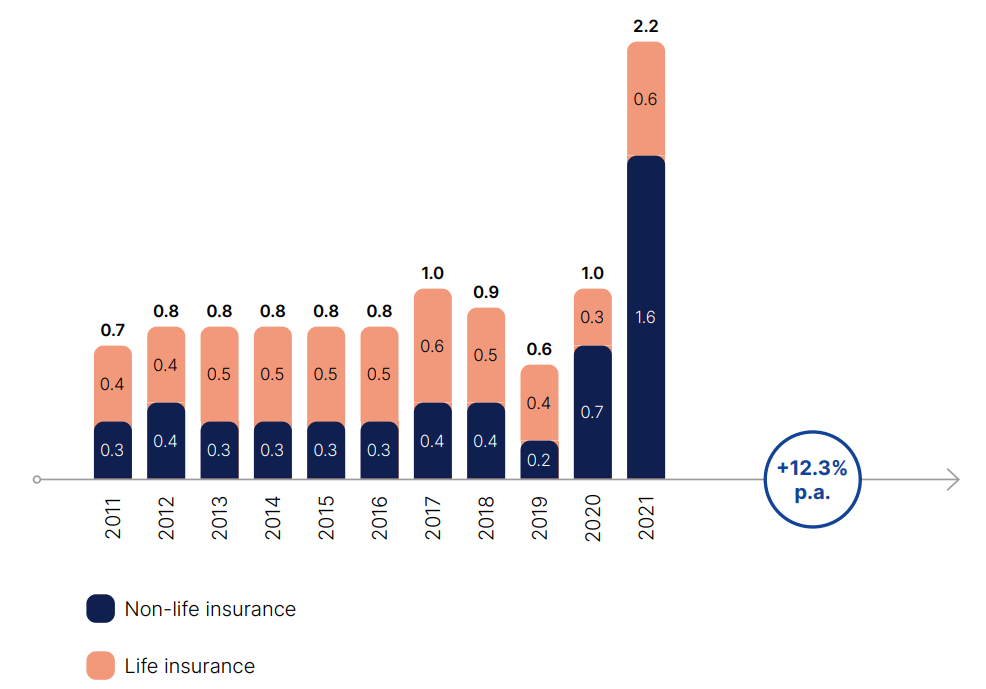

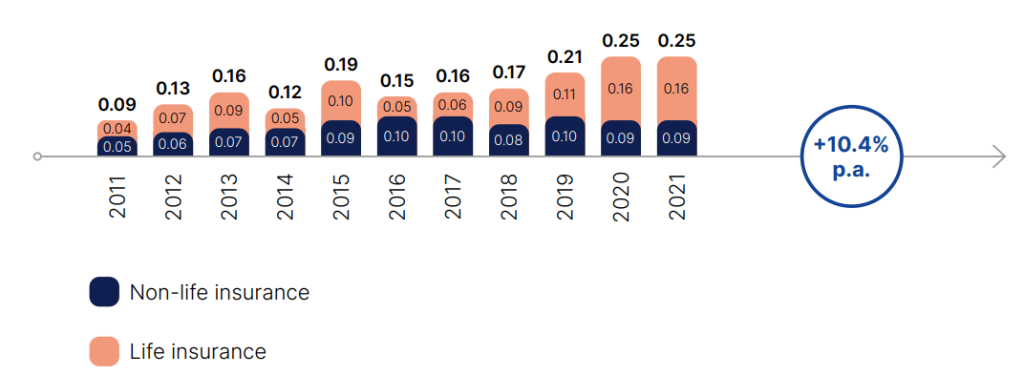

Between 2011 and 2021, the insurance sector in Luxembourg saw several shifts in terms of added value and taxes. Despite these changes, the number of employees increased by 1.5% p.a., while tax revenues grew by 10.4% p.a. Added value remained stable overall, showing a slight increase and positive results, especially in 2021.

The activities and results of both life and non-life insurance firms saw strong results in 2021, with non-life insurance’s technical results, in particular, improving materially over the year. This is due to incumbent and new market players’ efforts to develop their portfolios and increase profitability.

The life insurance sector also broke a 10-year record for premiums in 2021, rising by 32% compared to 2020.

The number of employees in the life and non-life sectors saw steady growth, with both experiencing an uptick in 2018 following two years of declines.

Source: Commissariat aux Assurances (CAA).

The overall added value remained stable between 2017 and 2020, despite fluctuations. Both sectors’ material increase in 2021 was estimated using the “net profit after tax” as a proxy, as not all data is currently available to determine 2021’s added value. This growth is primarily due to the notable increase in gross premiums (+14.4%) and net profit (+197.6%) in the nonlife business in 2021 compared to 2020.

Source : CAA. Données 2021 extrapolées à partir de 2011-2020.

Tax revenue generated by the insurance sector grew by 10.4% p.a. overall. The life sector saw the most significant increase (+14.2% p.a.) between 2011 and 2021, while the non-life sector grew by 5.8% p.a.

Source: CAA. 2021 data extrapolated from 2011–2020 data.