Dieter Putzeys

Partner – KPMG LuxembourgArticle written by KPMG as part of their sponsorship of ACA Innovation Award 2024

The insurance industry is at a critical inflection point, driven by the rapid evolution of AI. From optimizing claims processing to enhancing risks assessment, AI is transforming how insurers operate. Generative AI introduces capabilities that promise to increase efficiencies and innovation. However, despite the potential, insurers remain cautious due to barriers identified like data quality, trust and regulatory compliance.

The traditional AI market is projected to reach $79 billion by 2033 and generative AI is expected to grow into a $1.3 trillion market by 2032. Leading companies in the insurance sector recognize the importance of AI, with 72% of them already venturing into the topic. The critical question is: How can insurers navigate the obstacles and maximize AI’s value?

Successfully integrating AI requires establishing a solid foundation. This foundation begins with ensuring high quality and accurate data, strong cloud based infrastructure and agile operating models to leverage information. Digital transformation provides the scalability and flexibility needed for AI workloads, while agile methods enable faster adaptation to AI advancements. Early success often comes from solving specific problems, but scaling AI across the organization requires a wider strategic vision.

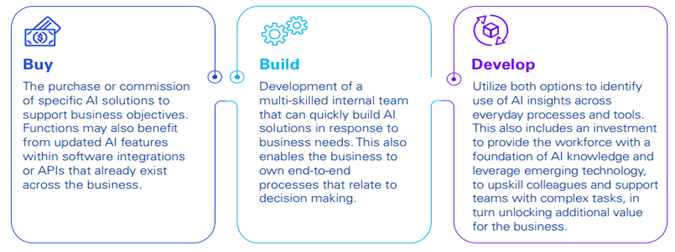

Insurers need to make the decision as to whether to buy, build or develop AI capabilities for their business.

With 47% of organizations globally establishing AI centers of excellence, industry leaders emphasize the importance of collaborating between departments and fostering innovation. By aligning AI strategies and business objectives, insurers can mitigate barriers and realize the potential of AI.

While AI offers significant opportunities and benefits, it also brings risks such as bias, data breaches, regulatory compliance, and environmental impact. Traditional AI systems can unintentionally cause discrimination by using sensitive data such as gender or race – and discrimination is illegal. Moreover, AI models may inherit biases from historical data, underscoring the need for explainable AI to maintain transparency and fairness. Generative AI introduces a new factor: confidentiality risks. As public AI systems can potentially violate data protection laws, insurers need to mitigate this by training staff, using specific AI solutions, and strengthening cybersecurity. Additionally, it is mandatory for all AI-driven processes to comply with relevant regulations such as GDPR and the EU AI act. Establishing AI centers of excellence can foster innovation and collaboration, helping insurers effectively manage challenges throughout the journey.

To successfully integrate AI into daily operations, insurers must identify strengths and possible weaknesses to apply AI mechanisms across key segments of the business, not just isolated processes. Building a hybrid approach where insurers manage risks while exploring AI’s potential is crucial to deliver products and services that solve customers’ needs.

As the landscape evolves rapidly, there is limited time to test and reflect on AI. Insurers must remain proactive if they are to stay competitive in the market. After all, the greatest risk in the age of AI is failing to act at all. It’s time to think big, start small and scale fast.

To achieve this, there is help at hand – KPMG’s maturity assessment framework can help leadership teams quickly identify core capabilities and prioritize use cases. This helps create the foundations that are essential for delivering high quality results.

Here are 5 key considerations for insurers in developing a successful AI approach:

The insurance industry has a huge opportunity on its hands. But to turn this opportunity into reality requires decisive action and a planned, systematic approach.

The basis for success is to build a solid foundation of accurate data, robust infrastructure and the setting of clear and measurable objectives. In addition, adopting a pragmatic mindset – thinking big, starting small and scaling fast – will enable insurance organizations to prioritize high value use cases and align AI and business objectives.

Those that successfully execute on AI will create the potential for optimized operations that improve the customer experience and drive more profitable business. The time to take the lead is now.

Data sources from Advancing AI across insurance